| Home | FAQs | Book Contents | Updates & News | Downloads |

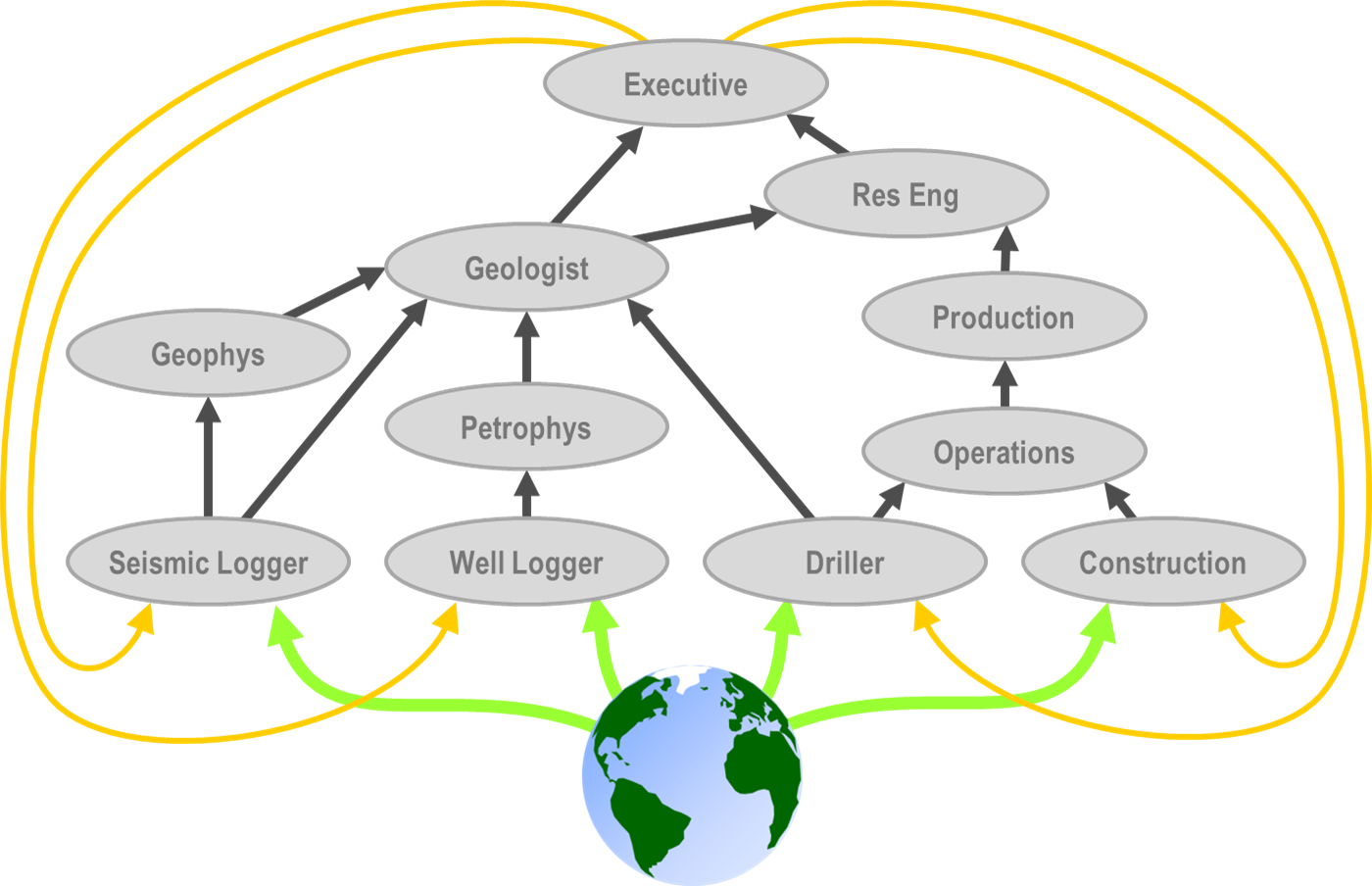

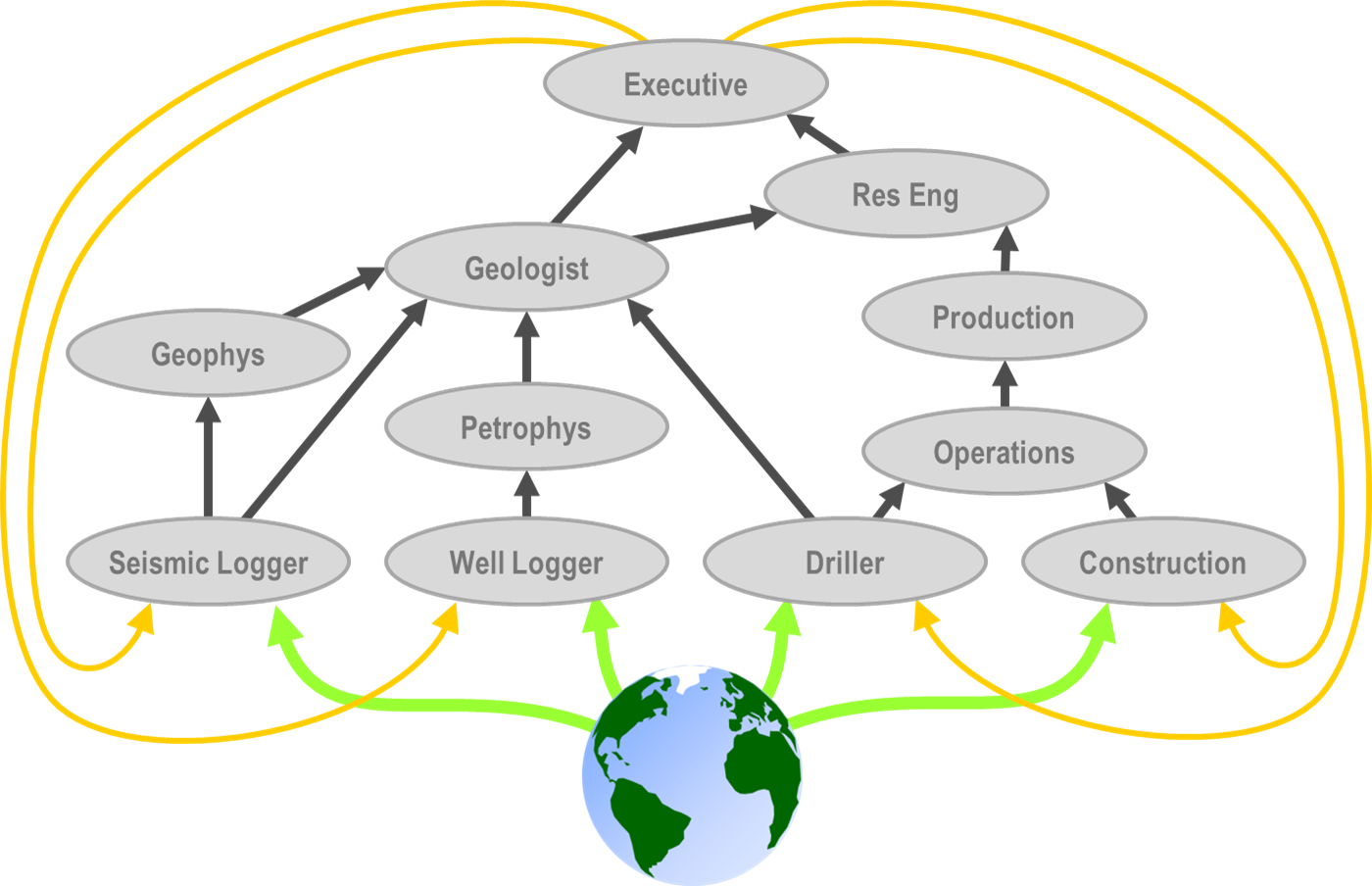

In the past I have claimed that there are five distinct approaches to demonstrating the value that data delivers to a working oil company. As someone with a bias towards "data driven" explanations the one that seems most interesting to me is the creation of some kind of a "tactical model" that tracks items of data, business activities, people, processes and such like within an oil company.

Creating one of these models has two distinct challenges, firstly working out some way you can describe the actions and beliefs of a few hundred experts in a form that is both exercisable and delivers insights, and secondly finding ways to work out the parameters that tune a model to respond in the same way as a real active oil company. The spark required to create such a model is hard to find, and the investment needed to objectively measure the parameters require budget support at a fairly high level. This is at least part of the explanation why so few of these models have ever been created (at least based on the number of publications I've seen).

The best example I am aware of was the work Noah did at Hess which was documented in a paper by Paul Haines and Mark Wiseman in 2011 (available from Noah's web site). That paper provided some great insight into the results, suggesting for example that increasing the budget for data handling by $1M would deliver improved decision making worth $30M to the company. For a number of reasons the paper was a bit more circumspect about explaining details of the internals of the model, or even the process that went to creating and validating it. This caution was, of course, entirely understandable, most oil companies are a bit reluctant to expose their internal processes too much.

It seems to me that by modelling realistic data flows in an active oil company we will, eventually, be able to characterise numerically the influence that technical sub-surface data has on the business results. However, there is much that needs to be done before we get to that point. First of all there is the question of how best to relate business activities, risks, data, domain specialists, external influences, "key applications" and other elements in ways that are both implementable and yet diagnostic. Do we need distinct models for different sizes of organisation? How do the parameters of such a model vary from one oil company to the next? How can we demonstrate that the behaviour of such a model is realistic? There will be those that complain that any model of oil company processes is too simplistic to produce any great insights, personally I disagree, but then I would. My own experience has been that models aid understanding and that experience manipulating them in various ways helps make sense of many counter-initiative real world behaviours. Indeed the appreciation that a good model can impart can generate significant improvements in the quality of your decisions, even when the model is based on "spherical cows in a vacuum".

Article 42 |

Articles |

RSS Feed |

Updates |

Intro |

Book Contents |

All Figures |

Refs |

Downloads |

Links |

Purchase |

Contact Us |

Article 44 |